|

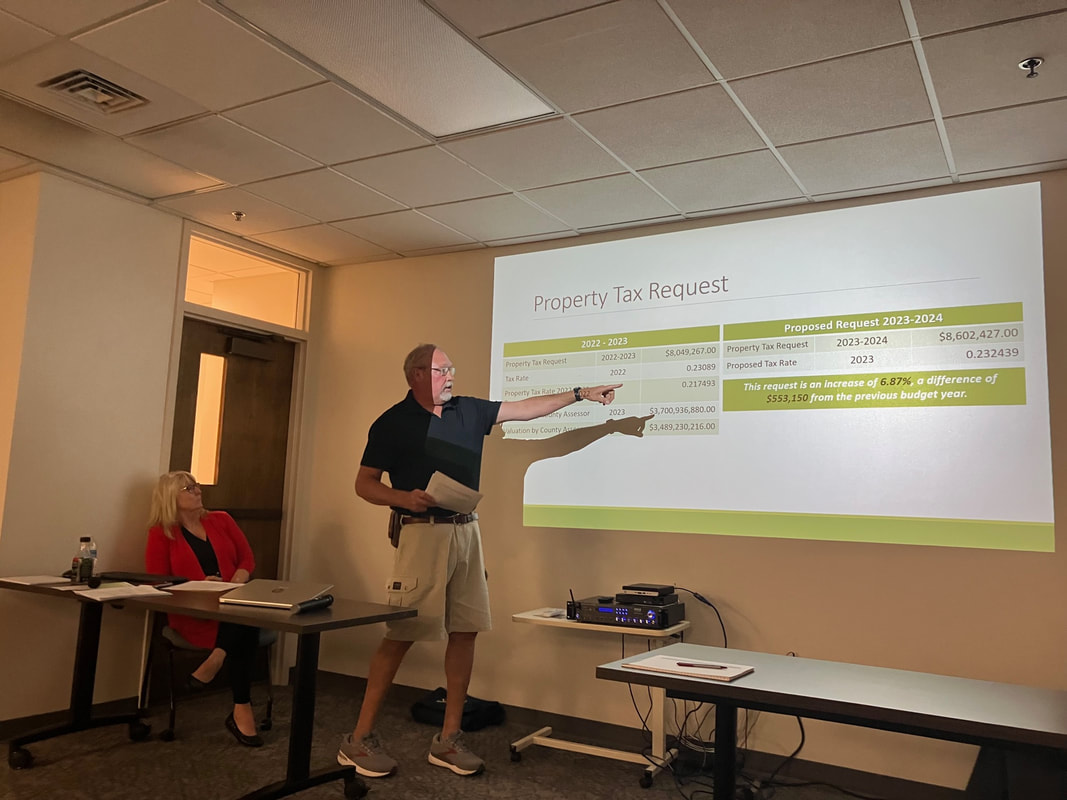

YORK – Due to the county having a tax asking increase of 6.87% this year, York County officials were required to hold a LB644/Statute 77-1631 hearing Monday night, Sept. 18. This hearing was required to the state’s somewhat new Property Tax Request Act, which was passed by the Nebraska Legislature in 2021 and took effect in 2022. The Act requires these hearings to be held by a taxing entity if the tax asking increases by more than 2% plus real growth. Last year’s tax asking, for the county, was $8,049,267. This year’s tax asking is $8,602,427. That’s an increase of $553,160. However, the county’s property tax levy will stay nearly the same, thanks to an increase in valuation. This year’s property tax will be .232439 per $100 of valuation. Last year’s was .230689. The LB644 hearing was opened Monday by York County Commissioner Chairman Randy Obermier. Also present were Commissioners Daniel Grotz, Stan Boehr and Woody Ziegler, as well as York County Assessor Kurt Bulgrin, York County Clerk Kelly Turner, York County Public Defender David Michel, York County Surveyor Rex Heiden, York County Highway Superintendent Harvey Keim and others. Approximately 22 individuals from the general public were on hand, many of them carrying the pink postcards they received in the mail, notifying them about the meeting. Obermier explained how the valuation went up by $211 million this year, from $3,489,230,216 to $3,700,936,880. He also provided the tax asking figures, as required by state law. Then he opened up the meeting for a question/answer session, although that is not required by the state law. One woman said, “We are never going to own our property, because if we don’t pay our taxes, you will take it away from us. The cost of everything is up and now we have to pay more in taxes.” “The valuation goes up, but the levy doesn’t go down?” another woman asked. “As taxpayers, we are tired of it. The city sales tax keeps going up, so we want our taxes to go down.” It was then noted that this hearing only pertained to the county tax asking, not any of the villages or cities in the county which have their own, separate tax asking – so therefore the York city sales tax would have nothing to do with this matter. “Governor Pillen is concerned about higher valuations and deficit spending,” said one man. “Sooner or later, you come to the point where you need to cut spending. Businesses do. Households do. Sooner or later, locally, we need to make some concessions to cut back on services. Where can we cut back instead of spending more, more, more?” “Part of my comments is to say if the county keeps raising its budget, then property owners will need to adjust their spending and many don’t have that option because they are on fixed incomes,” another man added. Obermier pointed out that homestead exemptions exist for individuals on fixed incomes and Bulgrin said he would provide that information on how to apply for such exemptions after the meeting. “My wonderment is that you keep coming back to us to up your amounts, but do you have any revenues you can sell to other lands?” a man asked. “For the record, taxpayers are saying no,” added one woman. “What portions of the budget caused the increase?” asked one attendee. Obermier pointed out, pertaining to some subsequent questions, that the matter at hand only dealt with the county – not the city of York – and he listed the various services the county provides. “The main area where we have increases is in personnel, then fuel, and it is one thing after another,” Obermier said. “We have had an overwhelming increase in personnel and with 110 employees, that is big money.” “Did you go that much up when paying people?” an attendee asked. “Last year, we used $1.25 million in inheritance tax funds to offset pay increases and we didn’t use any of that inheritance money for wages or salaries this year,” Obermier said. “This has created a higher tax asking this year. We kicked the can down the road and we are here now. On personnel fronts, we are under attack when it comes to law enforcement and corrections because the state keeps raising their wages at that level, in that field, by a lot. If we don’t keep raising wages and salaries, we will lose a lot of people and some services we can’t cut and we don’t think you want to cut out law enforcement. It comes down to what we want to cut. I think we did a good job with the budget, we nibbled down at what we could, we asked elected officials to cut their budgets back. But I also look at this increase as a 2-year increase because we offset the increases last year with the inheritance tax funds.” “At some point, we need to realize we have to diminish services,” one man from the audience said. “Every year, it is an option, but every year, we ask where do we start?” Obermier responded. “We can start with roads, we can start with law enforcement, we cut down those services but I don’t think anyone wants to do that.” “The way I see it, due to society, we will need more law enforcement and services because of the problems in society and the taxpayers shouldn’t be forced to keep paying increases to keep our property,” said a woman in the audience. “The way society is going, you will need to spend more and more.” Grotz addressed the earlier question about revenue streams for the county, saying property tax is the county’s only revenue. “We cannot have sales tax, per state law, because towns here already have it.” Obermier reiterated the point, saying the county cannot have its own sales tax because communities within the county have already passed their own. “I was in business,” said a man in the audience, “and when costs were up, I had to cut my own salary, maybe you need to consider that because this is getting way too high.” “And can you use more of the inheritance funds?” an audience member asked. “When looking at our budgets, we need to look at how they will affect things down the road,” Obermier said. “And the inheritance tax will go away someday in the future because it is under attack by the state legislature. We have a robust balance and we use some of that money for certain things, various things. It is being used. Last year, however, was the only year we used it to supplement raises in pay.” “The costs for farmers are going up, taxes are going up, but grain prices are going down,” a York County farmer said. “So it is a double whammy for the farmer.” “I share the angst I hear,” said another audience member to the commissioners. “But I personally appreciate you and your work on this, it is a difficult position. We appreciate your services. I will express my personal appreciation. And thank you for the explanation you are giving all of us. Thank you for your service to York County.” A few people asked about York’s city sales tax and where it goes, with Obermier and Grotz reminding them the only topic at hand was the county’s tax asking which has nothing to do with the city’s operations or revenue streams. “How can we put some pressure on, out there, to get some of the city’s and villages’ sales tax money?” a woman asked. “The one thing we can do is cut our own services, but someone will have to do without,” Obermier said. Another man asked if there was a way for the county to access lottery money, casino revenues and funds from the York County Development Corporation. The commissioners noted the investment the county makes for the operations of YCDC has the purpose of eventually adding valuation because of economic growth. One person asked if the county looks for state and federal grant dollars, which is done all the time for various departments and projects. “How do you prioritize your spending?” the commissioners were asked. “The budget process starts in May,” Obermier said. “We talk with all the elected officials and department heads. The budget committee dives into their numbers and picks away at it. We don’t shake our head and say ‘absolutely.’ Statutorily, we can’t budget elected officials out of doing their work. Then we all try to work together to make this work now and into the future.” It was also noted the commissioners already cut $700,000 from the proposed, earlier budget to get to where they are now. “This is my ninth year on the county board and I believe we are doing the best we can,” Obermier said. “Our jobs are open, up for election, every four years, so others can come in as well. It is a difficult process in trying to keep the best people, you don’t want to cut necessary services and you don’t want people working who don’t know what’s going on. We want to keep our competent people.” The tax asking hearing closed, but the commissioners remained there for quite some time, to speak individually with those who still had concerns, ideas and questions. Comments are closed.

|

Archives

July 2024

Categories

All

|

York County, Nebraska

Serving the citizens of central Nebraska since 1870

|

York County Courthouse

510 N Lincoln Ave, York, NE 68467 York County Highway Department 722 E. 25th Street, York, NE 68467 |

County Offices

Monday–Friday - 8:00am-5:00pm Court System Monday–Friday - 8:00am-12:00pm & 1:00pm-5:00pm Roads Department (April - October) Monday–Thursday 7:00am-5:30pm (November - March) Monday–Friday 7:00am-3:30pm |

Privacy Policy | Site hosted by Eckert Digital

YORK COUNTY, NEBRASKA

YORK COUNTY, NEBRASKA