|

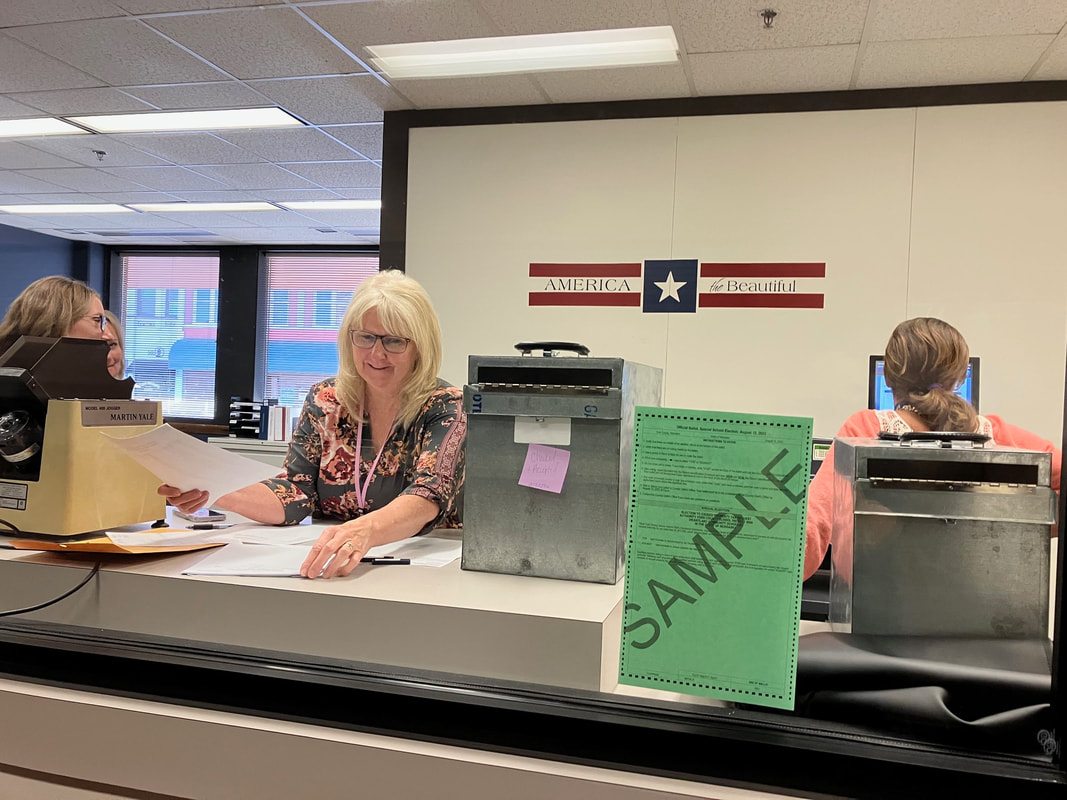

YORK COUNTY – The expansion/renovation of the Heartland School is now up in the air because not enough Heartland patrons voted in favor of a tax levy override in a special mail-in election. The ballots were counted Tuesday evening, August 15, at the York County Clerk/Election office, after the 5 p.m. deadline.

York County Clerk Kelly Turner hand-delivered the ballots sent to the Hamilton County Clerk’s office, where Heartland patrons in that county were able to take them. She arrived in Hamilton County at 5 p.m., after the deadline arrived, and drove them directly to her office where all the ballots were counted. No ballots were turned in by the few patrons in Fillmore County, according to the York County Clerk’s office. A total of 60% of voters had to vote in favor of the override in order for the project to continue at this point; however, 55.6% said yes and 44.4% said no. A simple majority in the matter was not sufficient, due to new state legislation. A total of 741 people sent in ballots. Of those, 656 were in York County and 85 were in Hamilton County. It must be noted that the canvassing board will convene at 10 a.m., on Wednesday, Aug. 16. Turner said the canvassing board will make sure all the numbers are correct – so the figures as of 6:45 p.m., Tuesday, Aug. 15, are still considered preliminary. The majority of Heartland District voters approved the bond issue in 2022 for the following improvements: main entrance and office expansion with safety renovations; a 4-classroom elementary addition; childcare facility; agriculture/industrial technology shop connection to the main building; an activity entrance renovation; a weight room addition; locker room addition; work in the north gym with air conditioning and bleacher improvements; fire sprinklers; an updated fire detection system and control; and an upgraded electrical capacity, power distribution systems and infrastructure. The tax request authority certified to the Heartland Community Schools for the 2023-24 budget year is $3,990,760. This represents an initial limit for the combined tax requests for both the district’s general fund and special building fund. For the upcoming budget year, the district needs a tax request authority of up to $5,821,786 combined between the two funds to finance the plans the board and the district have committed to. The difference between the two amounts — $1.8 million – is the additional tax request authority voters were asked to consider. New state legislation created this situation, when on May 25, the Nebraska Legislature passed LB 243, which created new limits to the tax request authority for the general fund and the special building fund in every school district. The legislature then passed LB 737 on June 1, which amended LB 243, making it immediately effective for the 2023-24 fiscal year. As a result, the district no longer had the tax request authority to finance the previously-approved facility improvements. Passage of the tax request authority required 60% of the voters’ approval, which as of Tuesday evening had not been achieved. It is unclear how the district will proceed at this point, pending the canvassing board’s determination on Wednesday. But historically, past canvassing boards have confirmed the findings of election counts by the county clerk’s office. Comments are closed.

|

Archives

July 2024

Categories

All

|

York County, Nebraska

Serving the citizens of central Nebraska since 1870

|

York County Courthouse

510 N Lincoln Ave, York, NE 68467 York County Highway Department 722 E. 25th Street, York, NE 68467 |

County Offices

Monday–Friday - 8:00am-5:00pm Court System Monday–Friday - 8:00am-12:00pm & 1:00pm-5:00pm Roads Department (April - October) Monday–Thursday 7:00am-5:30pm (November - March) Monday–Friday 7:00am-3:30pm |

Privacy Policy | Site hosted by Eckert Digital

YORK COUNTY, NEBRASKA

YORK COUNTY, NEBRASKA